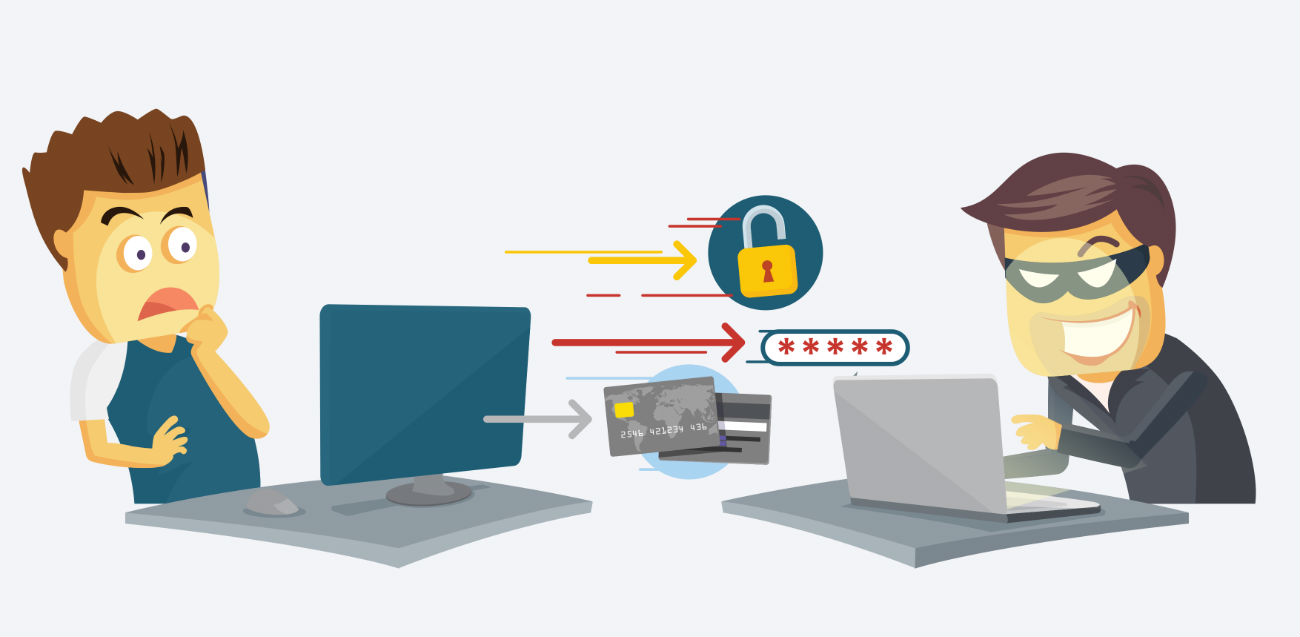

Insurance Fraud Detection Market, Detecting and stopping fraud related to financial or property insurance is known as insurance fraud detection. In order to anticipate future events, it makes use of a variety of software-based techniques to examine historical trends and happenings. Artificial intelligence (AI), machine learning, and conventional rule-based fraud analytics models are used by the programmed to do statistical analysis. Organizations frequently utilize insurance fraud detection for governance, risk, compliance, governance, fraud analytics, database security, and the identification of anomalies and vulnerabilities. During the purchase, sale, or underwriting of insurance, the programmed also looks for suspicious behavior by an insurance provider, agent, adjuster, or customer who is trying to gain illegal advantage. As a result, it has many uses in many different industries, including as banking, financial services, and insurance (BFSI), as well as in the automobile, healthcare, and retail sectors.

Insurance fraud detection is the process of finding and preventing fraud involving financial or property insurance. It use a range of software-based methodologies to look at historical trends and occurrences in order to predict future events. The application uses statistical analysis, machine learning, artificial intelligence (AI), and traditional rule-based fraud analytics methods. For governance, risk, compliance, governance, fraud analytics, database security, and the detection of anomalies and vulnerabilities, organizations typically use insurance fraud detection. The programmed also looks for suspicious behavior by an insurance provider, agent, adjuster, or customer who is attempting to obtain an unfair advantage during the purchase, sale, or underwriting of insurance.

One of the key reasons influencing the market expansion is the extensive use of insurance fraud detection for risk compliance and authentication across a variety of industries, including banking financing services and insurance (BFSI), automotive, retail, hospitality, and healthcare. Additionally, the rise in false claims, kidnappings, fatalities, and falsified medical records has accelerated the demand for efficient insurance fraud detection technologies. In addition, the operation, screening, and mining of photos and business rules using the Internet of Things (IoT) and artificial intelligence (AI) is boosting market growth.

Click Here To Request a Sample Copy of Market https://analyticsmarketresearch.com/sample-request/insurance-fraud-detection-market/876/

The Insurance Fraud Detection market report is a perfect foundation for people looking out for a comprehensive study and analysis of the Insurance Fraud Detection market. On the basis of historic growth analysis and current scenario of Insurance Fraud Detection market place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that facilitate deeper understanding of multiple aspects of global Insurance Fraud Detection market. This further helps user with their developmental strategy.

This report examines all the key factors influencing growth of global Insurance Fraud Detection market, including demand-supply scenario, pricing structure, profit margins, production and value chain analysis. Regional assessment of global Insurance Fraud Detection market unlocks a plethora of untapped opportunities in regional and domestic market places. Detailed company profiling enables users to evaluate company shares analysis, emerging product lines, scope of NPD in new markets, pricing strategies, innovation possibilities and much more.

Global Insurance Fraud Detection Market: Major Players

Simility

IBM

iovation

BRIDGEi2i Analytics Solutions

Software AG

BAE Systems

FRISS

ACI Worldwide

Perceptiviti

Kount

Experian

SAS Institute

LexisNexis

SAP

FICO

Fiserv

Global Insurance Fraud Detection: Types

Fraud Analytics

Authentication

Governance, Risk, and Compliance

Others

Global Insurance Fraud Detection: Applications

Small and Medium-sized Enterprises (SMEs)

Large Enterprises

Global Insurance Fraud Detection: Regional Analysis

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Insurance Fraud Detection report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click Here To Purchase This Market Research Report

FAQs:

- What Insurance Fraud Detection segment controls the biggest share of all applications?

- What is the Insurance Fraud Detection size?

- What is the Insurance Fraud Detection status right now?

- Which Insurance Fraud Detection driver particularly caught your attention?